Navigating The 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

Associated Articles: Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

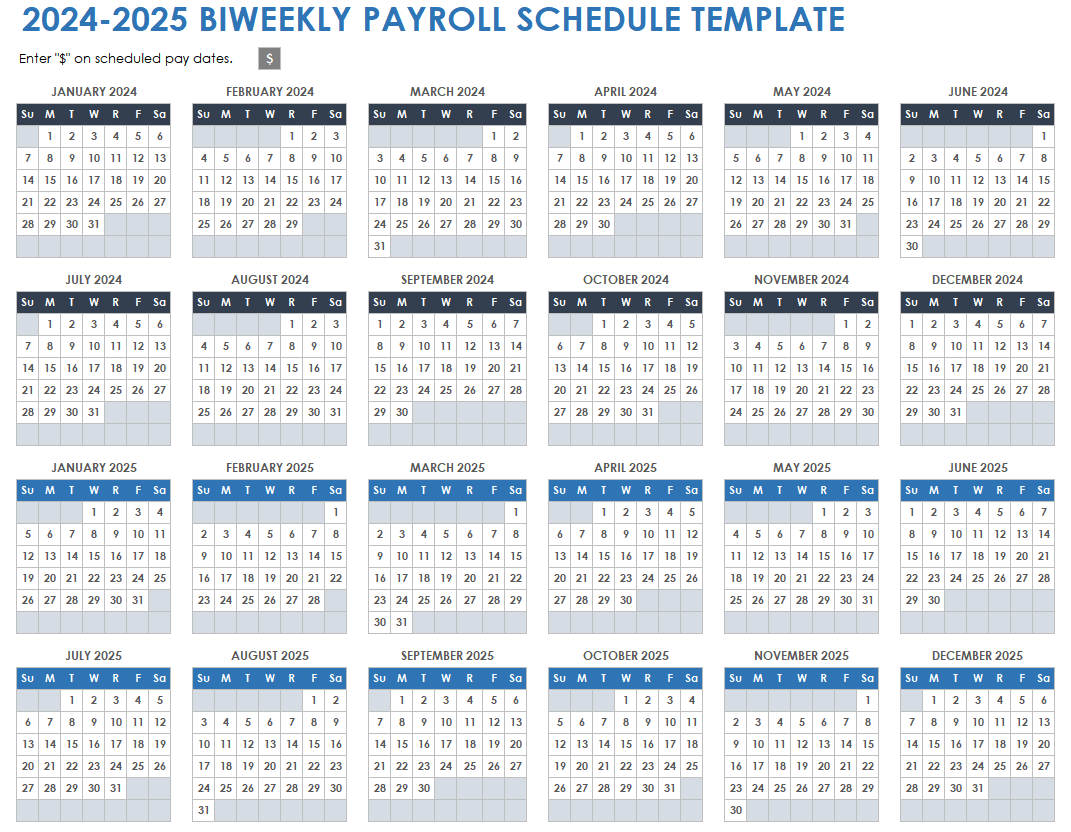

The 12 months 2025 is quickly approaching, and with it comes the necessity for meticulous planning, particularly for companies managing payroll. For organizations working on a semi-monthly payroll schedule, understanding and precisely predicting fee dates is essential for environment friendly money circulate administration, worker satisfaction, and authorized compliance. This text supplies an in depth overview of making and using a semi-monthly payroll calendar for 2025, highlighting key concerns and providing sensible ideas for seamless payroll processing.

Understanding Semi-Month-to-month Payroll

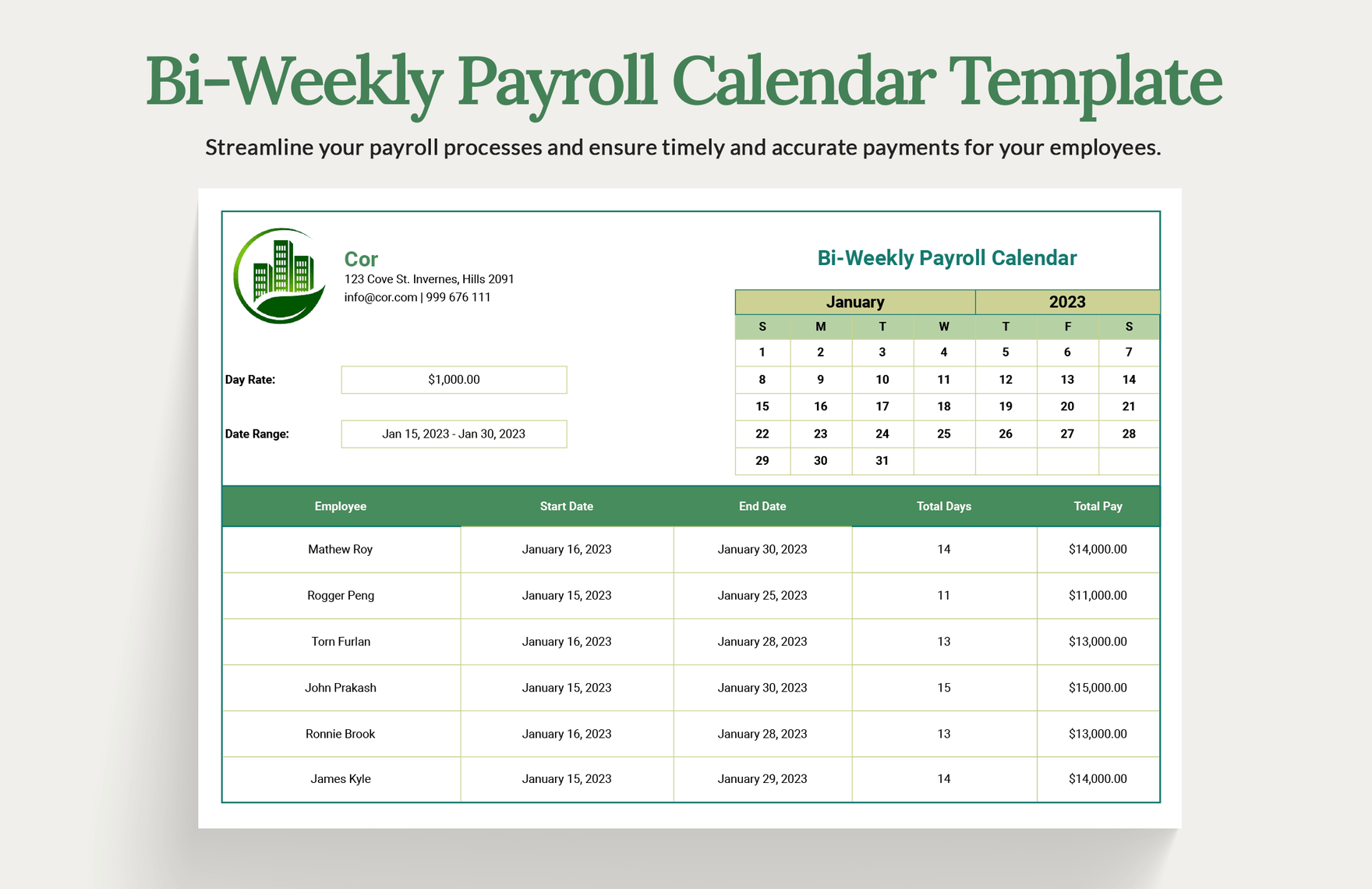

Semi-monthly payroll means workers obtain their paychecks twice a month, sometimes on the fifteenth and the final day of the month (or the closest previous enterprise day if the fifteenth or final day falls on a weekend or vacation). This differs from bi-weekly payroll, which pays workers each two weeks, leading to a various variety of pay intervals per 12 months. The consistency of semi-monthly payroll affords predictable revenue for workers and simplifies budgeting for companies.

Constructing Your 2025 Semi-Month-to-month Payroll Calendar

Making a 2025 semi-monthly payroll calendar requires cautious consideration of a number of elements:

-

Begin Date: Decide your organization’s established payroll cycle begin date. That is the primary day of the pay interval. For instance, in case your first pay interval begins on January 1st, 2025, your first payday can be January fifteenth, 2025.

-

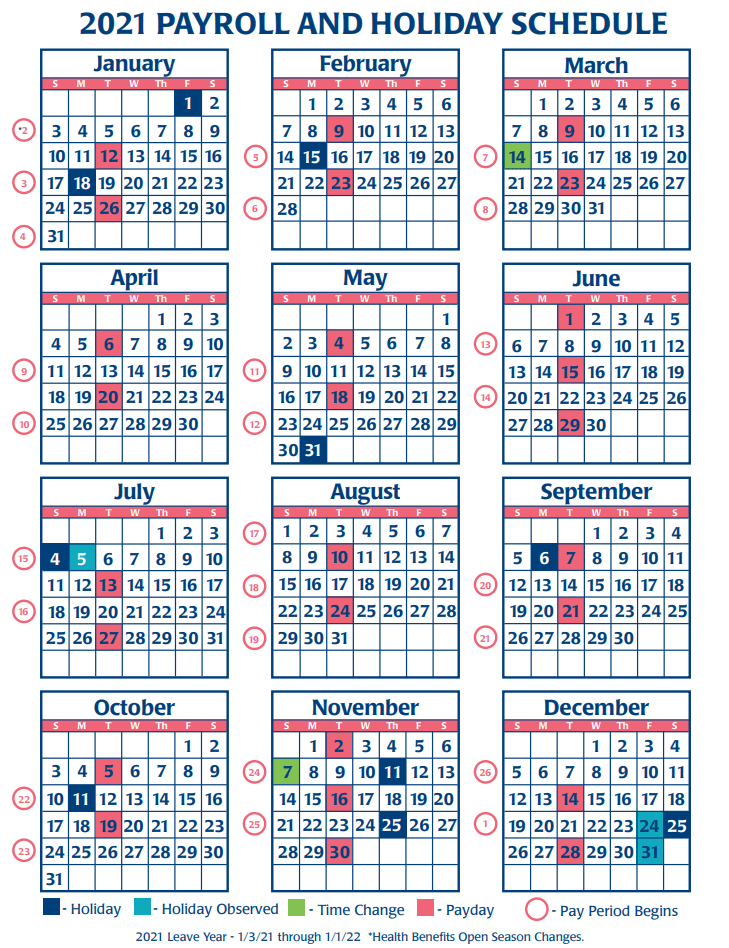

Holidays: Determine all federal and state holidays in 2025. If a payday falls on a vacation, you need to decide whether or not to pay workers early or modify the fee date to the previous enterprise day. Consistency is vital to keep away from confusion and keep worker belief.

-

Weekends: Account for weekends. If a payday falls on a Saturday or Sunday, the fee ought to be processed on the previous Friday.

-

Leap Yr: 2025 just isn’t a intercalary year, simplifying the calendar calculations. Nonetheless, keep in mind to account for the various variety of days in every month.

-

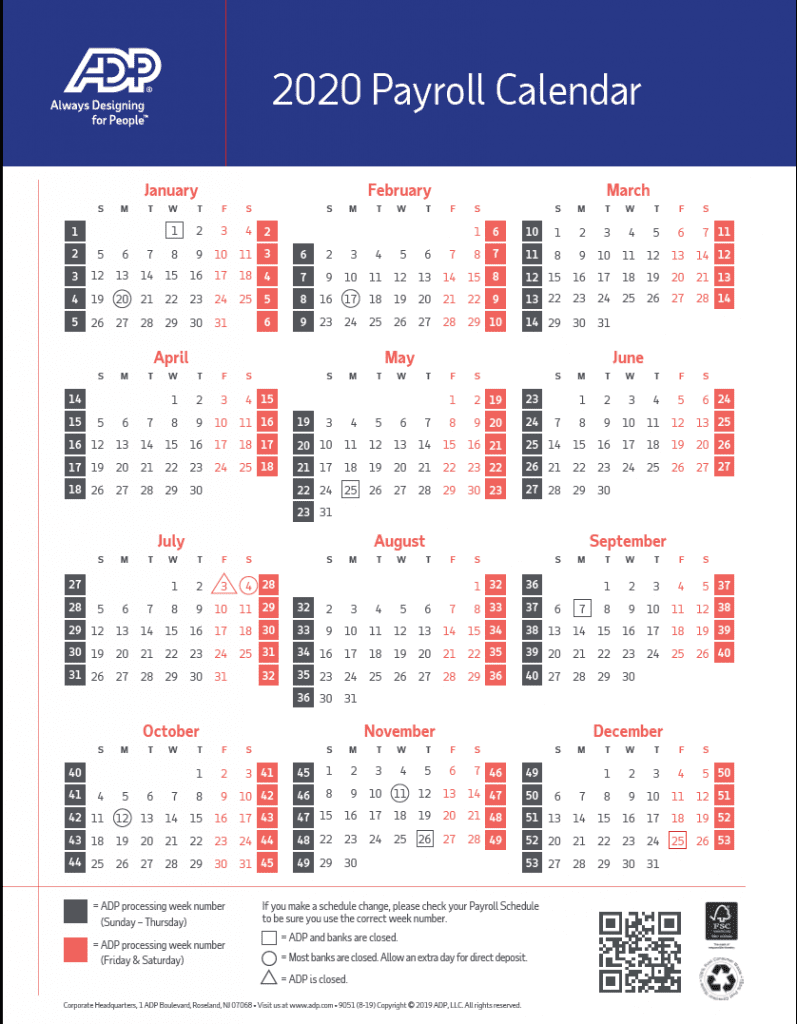

Payroll Software program: Make the most of payroll software program to automate the method. Most payroll software program packages can mechanically generate a payroll calendar based mostly in your chosen pay schedule and company-specific parameters, together with vacation changes. This minimizes guide errors and ensures accuracy.

Pattern 2025 Semi-Month-to-month Payroll Calendar

Whereas a whole, detailed calendar can be intensive, this is a pattern illustrating the method:

| Pay Interval | Begin Date | Finish Date | Payday (fifteenth) | Payday (Finish of Month) |

|---|---|---|---|---|

| 1 | January 1st | January fifteenth | January fifteenth | January thirty first |

| 2 | January sixteenth | January thirty first | February fifteenth | February twenty eighth |

| 3 | February 1st | February fifteenth | February fifteenth | February twenty eighth |

| 4 | February sixteenth | February twenty eighth | March fifteenth | March thirty first |

| 5 | March 1st | March fifteenth | March fifteenth | March thirty first |

| 6 | March sixteenth | March thirty first | April fifteenth | April thirtieth |

| …and so forth… | … | … | … | … |

Notice: This can be a simplified instance. The precise calendar must account for particular holidays and weekend changes. It is essential to seek the advice of a complete 2025 vacation calendar in your particular area.

Vital Issues for Correct Payroll Processing

-

Timekeeping: Correct timekeeping is paramount for semi-monthly payroll. Implement a strong time and attendance system to make sure all hours labored are precisely recorded. This avoids discrepancies and potential disputes.

-

Information Entry: Double-check all information entered into your payroll system. Errors in worker info, hours labored, or pay charges can result in vital monetary penalties.

-

Tax Withholding: Keep up to date on all federal, state, and native tax legal guidelines relating to payroll withholding. Incorrect tax withholding may end up in penalties and authorized points.

-

Compliance: Guarantee your payroll practices adjust to all related labor legal guidelines and laws. This consists of minimal wage legal guidelines, additional time pay, and different worker advantages.

-

File Protecting: Preserve correct and arranged payroll information. These information are essential for auditing functions and might be important in resolving disputes or answering inquiries from workers or authorities companies.

-

Worker Communication: Clearly talk the payroll schedule to workers. Present them with entry to their pay stubs and supply channels for addressing any payroll-related inquiries promptly.

Using Know-how for Environment friendly Payroll Administration

Trendy payroll software program affords quite a few options to streamline the semi-monthly payroll course of:

-

Automated Calculations: Software program mechanically calculates gross pay, deductions, and web pay, lowering the chance of guide errors.

-

Direct Deposit: Provide direct deposit to workers for quicker and extra handy fee.

-

Reporting and Analytics: Generate complete reviews to trace payroll bills, analyze labor prices, and determine developments.

-

Integration: Combine your payroll software program with different enterprise techniques, equivalent to HR and accounting software program, for seamless information circulate.

-

Cloud-Based mostly Options: Cloud-based payroll options supply accessibility from wherever with an web connection, bettering flexibility and effectivity.

Conclusion

Creating and using a well-planned 2025 semi-monthly payroll calendar is crucial for profitable enterprise operations. By rigorously contemplating holidays, weekends, and leveraging know-how, companies can guarantee correct and well timed payroll processing, fostering worker satisfaction and sustaining authorized compliance. Keep in mind that proactive planning and a spotlight to element are essential to keep away from potential points and guarantee a clean payroll course of all through your entire 12 months. Repeatedly assessment and replace your payroll calendar and procedures to adapt to altering laws and enterprise wants. Proactive administration of your payroll calendar will contribute considerably to the general monetary well being and operational effectivity of your group.

Closure

Thus, we hope this text has supplied helpful insights into Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information. We admire your consideration to our article. See you in our subsequent article!

Leave a Reply