Navigating The 2025 State Pay Interval Calendar: A Complete Information

Navigating the 2025 State Pay Interval Calendar: A Complete Information

Associated Articles: Navigating the 2025 State Pay Interval Calendar: A Complete Information

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Navigating the 2025 State Pay Interval Calendar: A Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Navigating the 2025 State Pay Interval Calendar: A Complete Information

The state pay interval calendar for 2025 is a vital doc for state workers, impacting the whole lot from budgeting private funds to understanding payroll deadlines. This complete information goals to demystify the calendar, offering a framework for understanding its construction, potential variations throughout states, and sensible recommendation for efficient monetary planning. Whereas a selected, state-by-state calendar can’t be supplied right here because of the sheer quantity of variations throughout the US, this text outlines the frequent options, potential complexities, and important issues that can assist you navigate your personal state’s 2025 pay schedule.

Understanding the Fundamentals of State Pay Interval Calendars

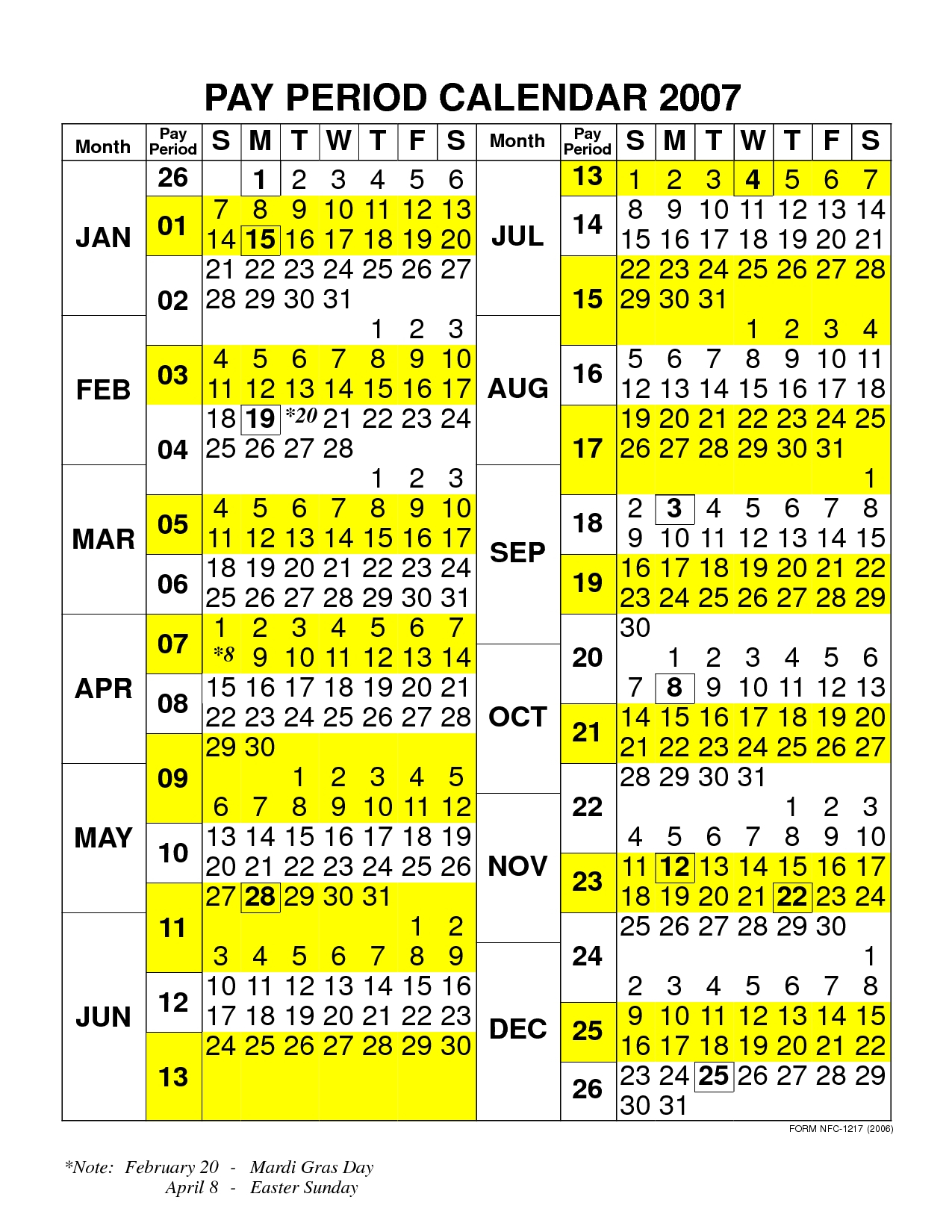

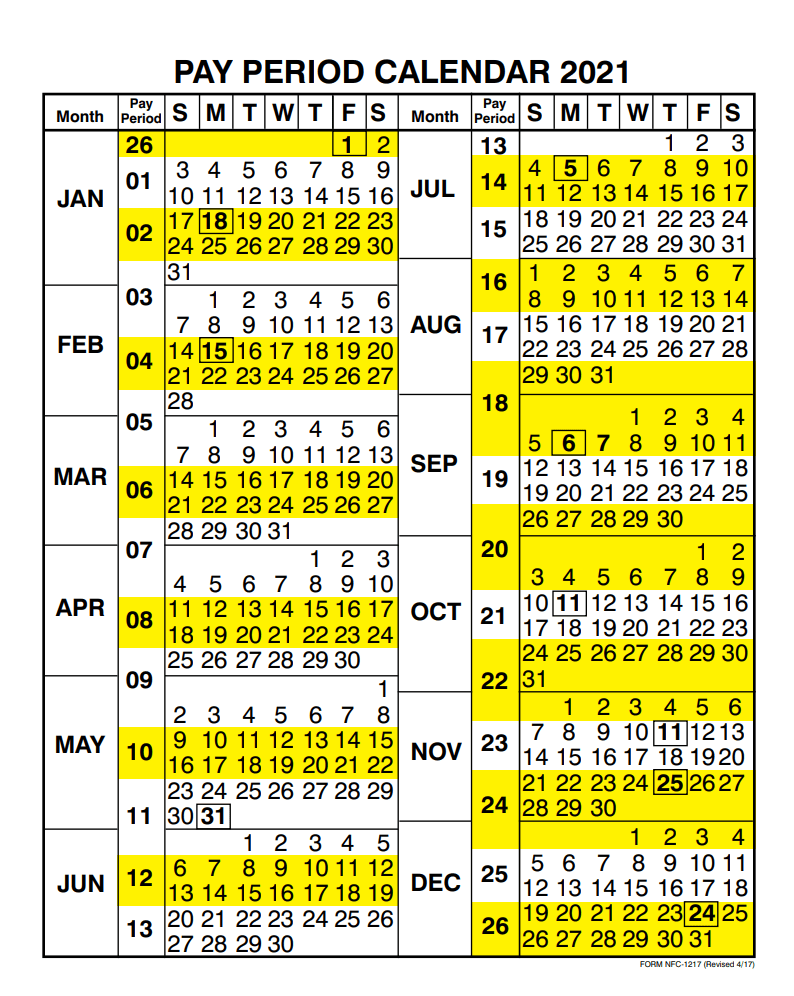

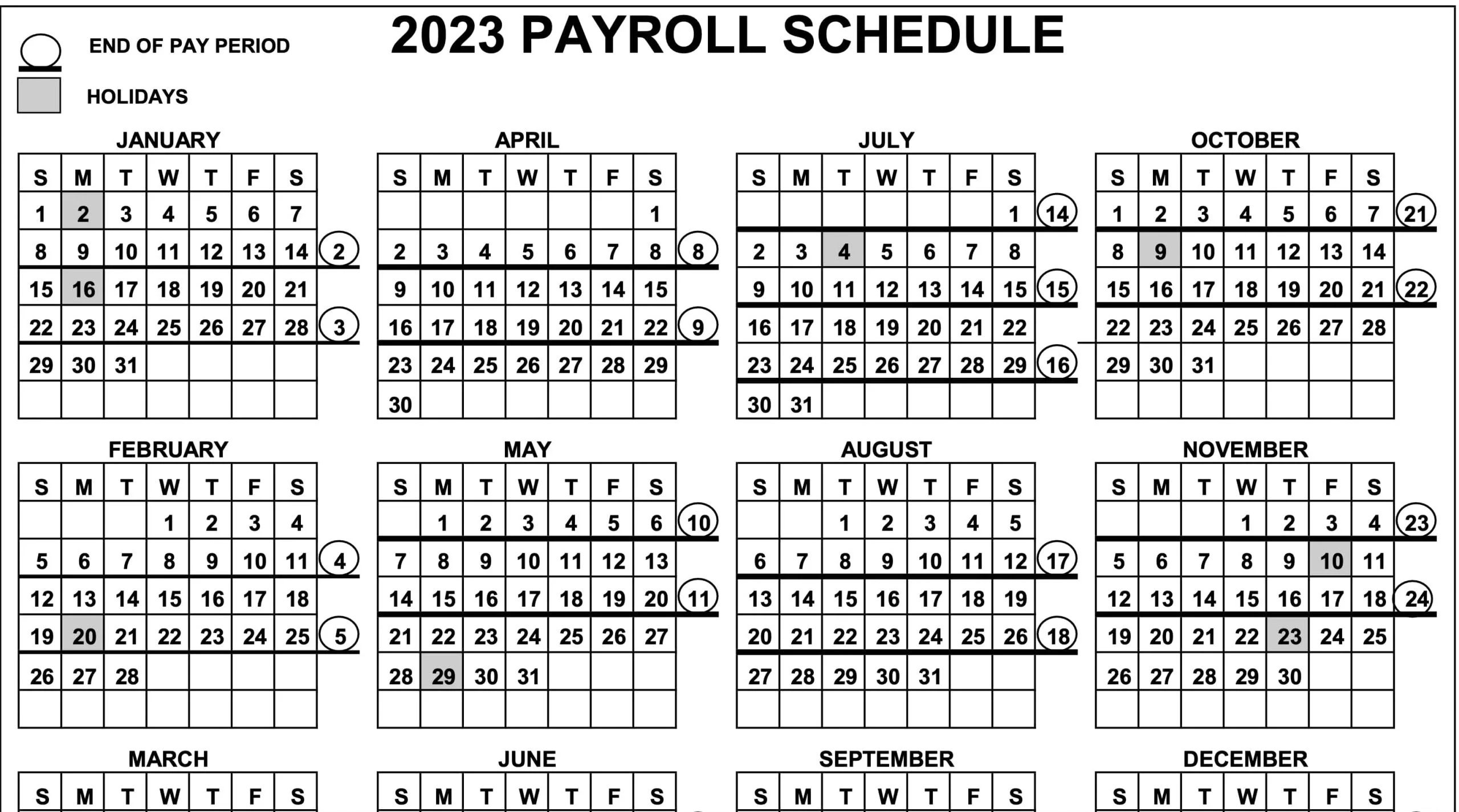

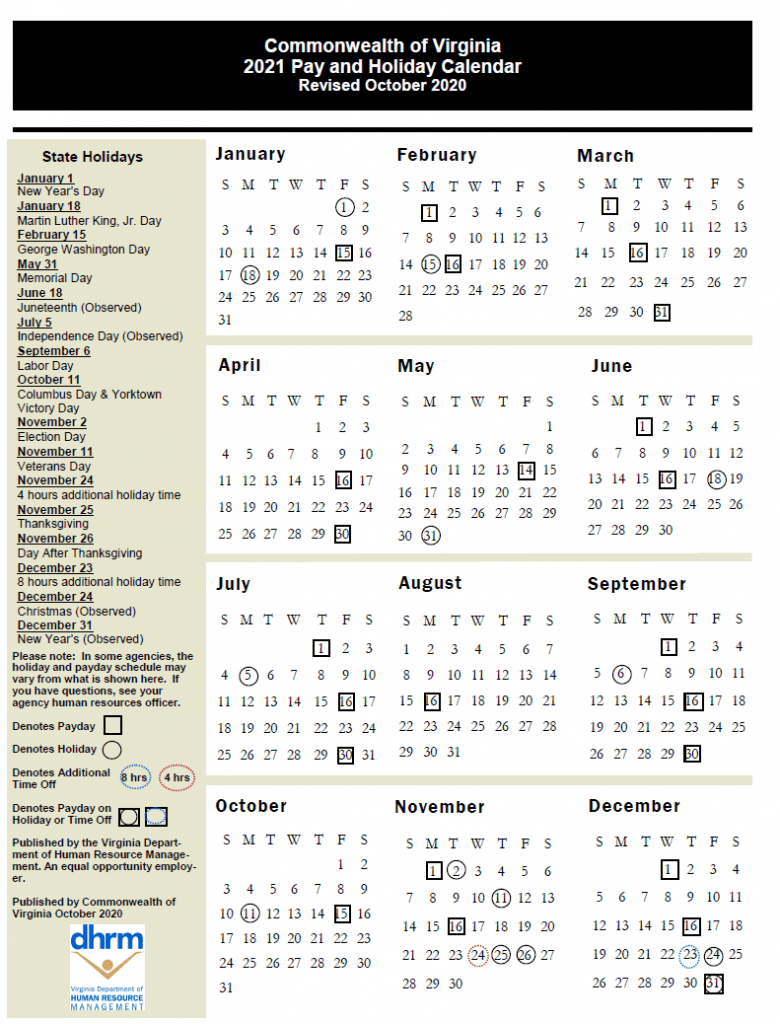

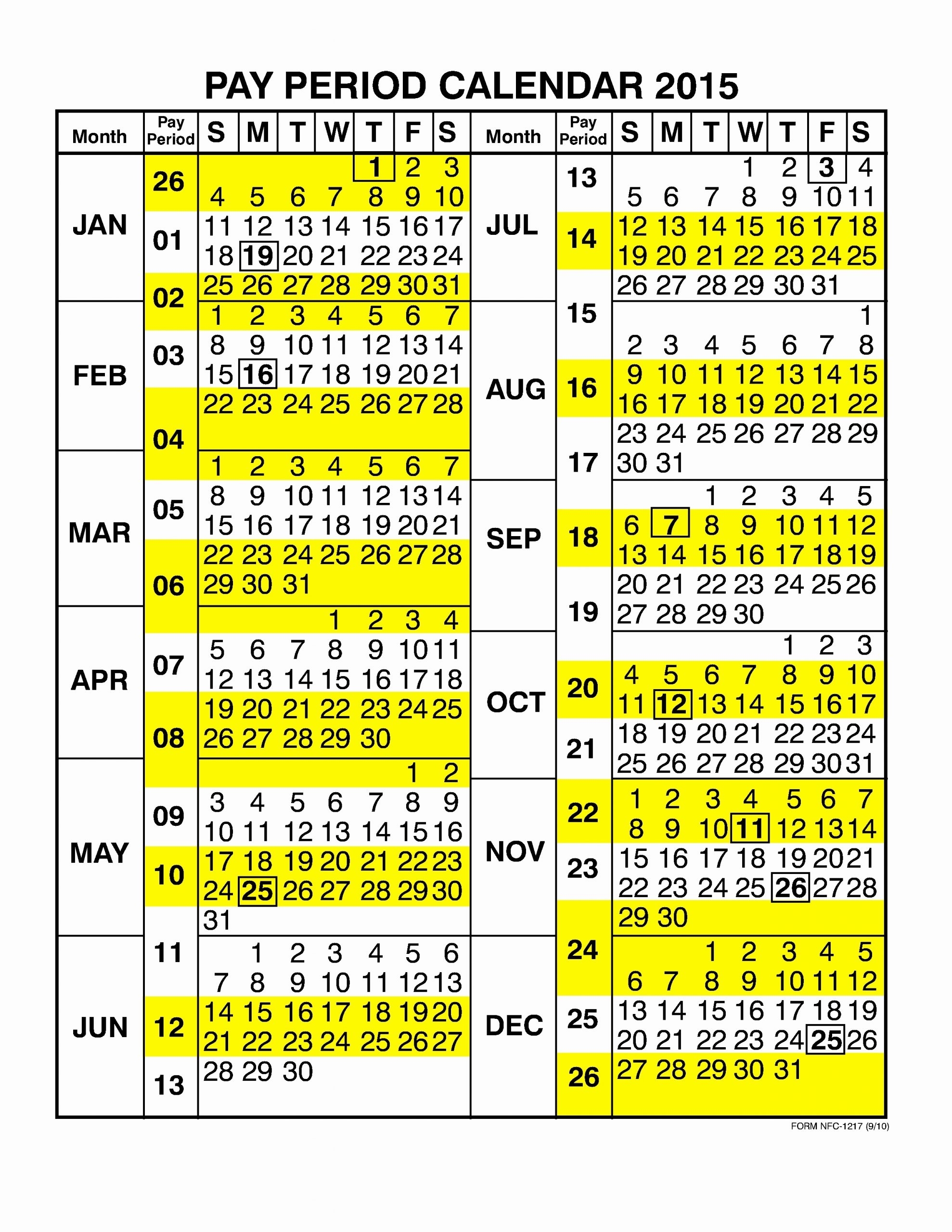

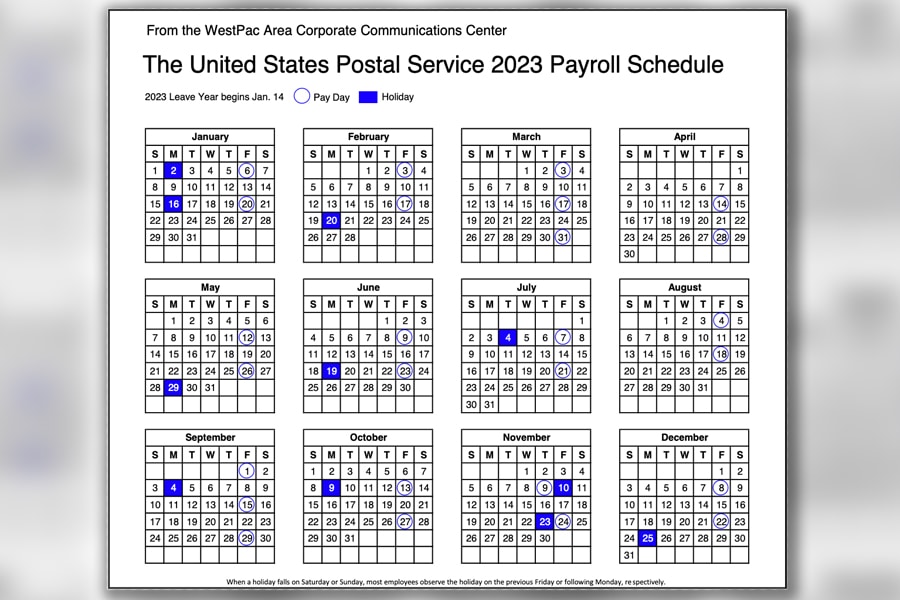

State pay durations usually comply with a bi-weekly or semi-monthly schedule. A bi-weekly schedule means workers are paid each two weeks, leading to 26 pay durations yearly. A semi-monthly schedule entails fee twice a month, often on the fifteenth and the final day of the month, leading to 24 pay durations per 12 months. The particular schedule is decided by every particular person state, and sometimes by the particular company or division inside the state authorities.

The 2025 calendar will replicate this chosen schedule, itemizing the particular pay dates for every interval. These dates are essential for budgeting, invoice funds, and general monetary administration. The calendar will typically embrace further data equivalent to:

- Pay Interval Quantity: A sequential quantity figuring out every pay interval inside the 12 months.

- Pay Interval Dates: The beginning and finish dates of the work interval for which fee is issued.

- Pay Date: The date on which the wage or wages are deposited into the worker’s account.

- Holidays: Identification of state holidays which will influence pay durations or end in adjusted pay dates.

- Go away Accrual: Data concerning the accrual of trip, sick, or different sorts of go away throughout every pay interval.

Variations Throughout States: A Key Consideration

It is essential to know that there isn’t any single, common state pay interval calendar for 2025. Every state authorities operates independently, setting its personal payroll schedules and insurance policies. Components contributing to this variation embrace:

- State Legal guidelines and Laws: State legal guidelines might mandate particular payroll practices or rules affecting the pay interval construction.

- Budgetary Concerns: The state’s budgetary cycle can affect the timing of payroll processing.

- Administrative Effectivity: The state’s human assets and payroll departments might select a schedule that most closely fits their operational wants.

- Union Contracts: In states with unionized state workers, collective bargaining agreements might stipulate particular pay interval preparations.

Accessing Your State’s 2025 Pay Interval Calendar

Probably the most dependable supply on your state’s 2025 pay interval calendar is your state’s authorities web site, particularly the human assets or payroll division. These web sites usually publish the calendar effectively upfront of the brand new 12 months, permitting workers ample time to plan their funds. Search for sections labeled "Payroll," "Human Sources," "Worker Sources," or related designations.

In case you can’t find the calendar on-line, contact your state’s human assets or payroll division straight. They’ll offer you the official calendar and reply any questions you might have about your pay schedule. Your quick supervisor or division administrator might also be capable to present this data.

Using the Calendar for Efficient Monetary Planning

The 2025 state pay interval calendar is an important instrument for efficient private monetary administration. Listed here are some methods to put it to use successfully:

- Budgeting: Use the pay dates to create a sensible price range, guaranteeing that you just account for all bills and earnings all year long. Contemplate the influence of any potential variations in pay durations, equivalent to shorter or longer durations attributable to holidays.

- Invoice Funds: Schedule invoice funds to coincide along with your pay dates, avoiding late charges and sustaining a wholesome credit score rating.

- Financial savings Objectives: Use the calendar to trace your progress in the direction of financial savings targets, guaranteeing that you just allocate adequate funds every pay interval.

- Tax Planning: Perceive the influence of your pay schedule in your annual tax legal responsibility. The calendar may also help you estimate your tax withholdings and plan for any tax funds.

- Funding Planning: Align your funding methods along with your pay schedule, guaranteeing that you just make common contributions to your retirement accounts or funding portfolios.

- Emergency Fund: Use the calendar to trace your contributions to an emergency fund, guaranteeing that you’ve adequate financial savings to cowl sudden bills.

Coping with Potential Calendar Discrepancies or Modifications

Whereas states attempt for consistency, sudden adjustments to the pay interval calendar can happen. These could also be attributable to unexpected circumstances, legislative adjustments, or system updates. It’s essential to:

- Monitor Updates: Frequently verify your state’s human assets web site for any bulletins or revisions to the calendar.

- Talk with HR: In case you discover any discrepancies or inconsistencies, contact your state’s human assets division for clarification.

- Keep Data: Make a copy of the official pay interval calendar on your information, and word any adjustments or updates.

Conclusion:

The 2025 state pay interval calendar is a crucial useful resource for state workers, facilitating monetary planning and guaranteeing well timed fee. By understanding the fundamental construction, acknowledging the variations throughout states, and actively using the calendar for monetary planning, state workers can successfully handle their funds and navigate the complexities of the state payroll system. Keep in mind to at all times discuss with your particular state’s official calendar and phone your human assets division for any questions or issues. Proactive engagement with the knowledge supplied by your state authorities ensures a smoother monetary 12 months.

Closure

Thus, we hope this text has supplied beneficial insights into Navigating the 2025 State Pay Interval Calendar: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!

Leave a Reply