Navigating The USD 457(b) Plan Panorama: A 2025-2025 Calendar And Complete Information

Navigating the USD 457(b) Plan Panorama: A 2025-2025 Calendar and Complete Information

Associated Articles: Navigating the USD 457(b) Plan Panorama: A 2025-2025 Calendar and Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Navigating the USD 457(b) Plan Panorama: A 2025-2025 Calendar and Complete Information. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Navigating the USD 457(b) Plan Panorama: A 2025-2025 Calendar and Complete Information

The USD 457(b) plan, a tax-advantaged retirement financial savings automobile obtainable to authorities workers and sure non-profit staff, gives a robust device for constructing a safe monetary future. Nevertheless, understanding its intricacies, maximizing its advantages, and navigating the ever-changing panorama of rules requires cautious planning and constant engagement. This text serves as a complete information, using a conceptual "2025-2025 calendar" as an instance key dates and issues all through a hypothetical ten-year interval inside a 457(b) plan’s lifespan. Whereas particular dates will range primarily based on particular person circumstances and plan specifics, this framework gives a worthwhile roadmap for efficient 457(b) planning.

Understanding the USD 457(b) Plan:

Earlier than diving into the calendar, let’s briefly recap the core options of a 457(b) plan:

- Tax-Deferred Development: Contributions are made pre-tax, which means you do not pay earnings taxes on the cash till it is withdrawn in retirement. This permits your investments to develop tax-free till distribution.

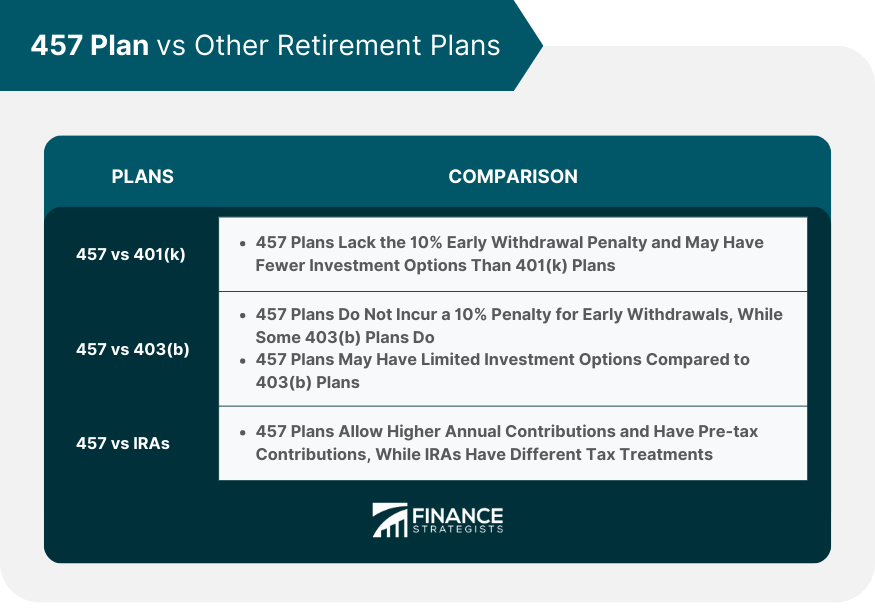

- Excessive Contribution Limits: 457(b) plans usually have larger contribution limits than conventional 401(ok) plans, permitting for extra aggressive financial savings. These limits are adjusted yearly by the IRS.

- Early Withdrawal Choices: Not like conventional IRAs and 401(ok)s, 457(b) plans usually supply extra versatile early withdrawal choices, though penalties might apply relying on the circumstances.

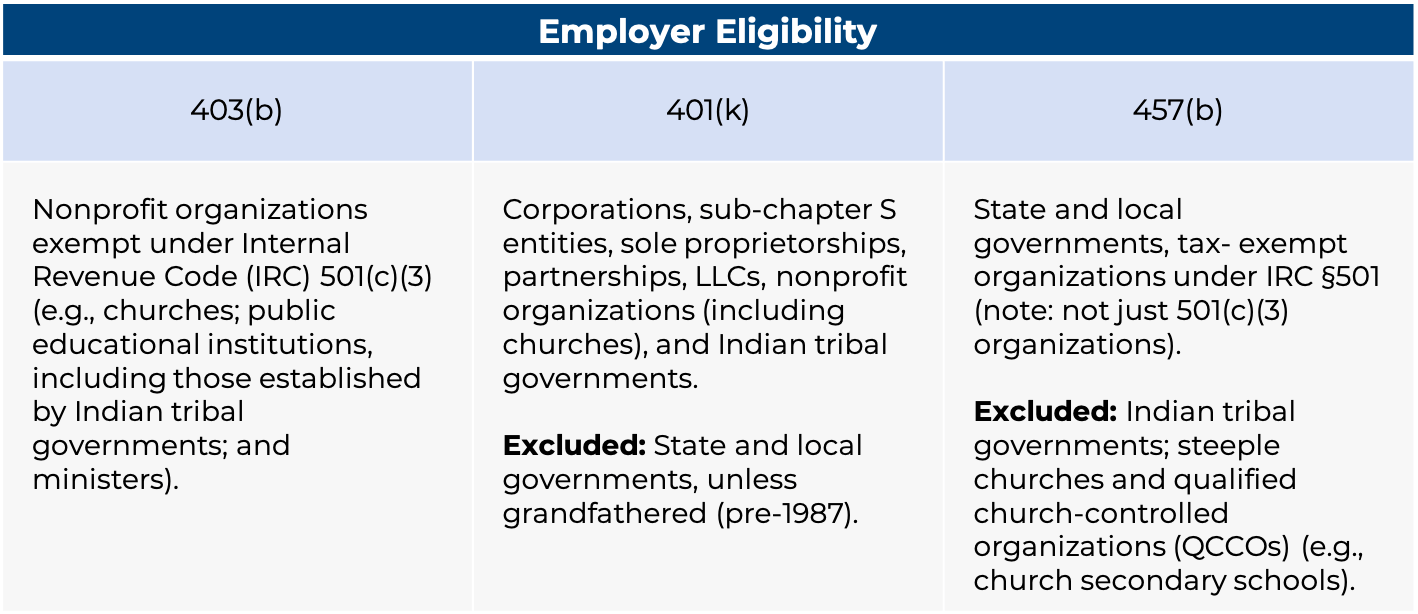

- Authorities and Non-Revenue Workers: Eligibility is primarily restricted to authorities workers on the federal, state, or native stage, and sure non-profit workers.

- Plan Variations: The specifics of a 457(b) plan can range considerably relying on the employer sponsoring the plan. It is essential to assessment your plan’s particular paperwork.

The Conceptual 2025-2025 Calendar: A Decade of 457(b) Planning:

This calendar outlines key issues throughout a ten-year interval, specializing in strategic planning relatively than particular dates that are topic to alter.

Yr 1 (2025): Basis and Evaluation

- January: Assessment your employer’s 457(b) plan paperwork totally. Perceive contribution limits, funding choices, and withdrawal guidelines.

- February-March: Assess your present monetary scenario. Decide your retirement targets and the way a lot it’s essential to save to attain them. Contemplate consulting a monetary advisor.

- April-December: Start contributing to your 457(b) plan. Begin with a contribution quantity you may comfortably afford and steadily enhance it over time. Contemplate diversifying your investments throughout completely different asset lessons.

Yr 2-5 (2026-2029): Development and Refinement

- Annual Assessment: Assessment your funding efficiency yearly. Rebalance your portfolio as wanted to keep up your required asset allocation.

- Contribution Changes: Regulate your contribution quantity primarily based in your earnings, monetary targets, and funding efficiency. Maximize contributions if potential, contemplating your general monetary image.

- Schooling: Proceed studying about funding methods and retirement planning. Attend webinars, learn books, or seek the advice of with a monetary advisor.

- Emergency Fund: Guarantee you’ve got a ample emergency fund separate out of your retirement financial savings. This protects you from sudden bills that may drive you to withdraw out of your 457(b) prematurely.

Yr 6-8 (2030-2032): Mid-Time period Analysis and Adjustment

- Complete Assessment: Conduct an intensive assessment of your retirement plan, together with your 457(b) plan, different retirement accounts (401k, IRA), and general monetary scenario.

- Retirement Projections: Use on-line instruments or seek the advice of a monetary advisor to undertaking your retirement earnings primarily based in your present financial savings and anticipated future contributions.

- Course Correction: Regulate your financial savings technique primarily based in your retirement projections. Enhance contributions if essential or discover different financial savings autos to complement your retirement earnings.

- Beneficiary Designation: Assessment and replace your beneficiary designations on your 457(b) plan. Guarantee your needs are precisely mirrored.

Yr 9-10 (2033-2034): Strategic Planning for Retirement

- Withdrawal Technique: Start planning your withdrawal technique for retirement. Contemplate elements corresponding to your anticipated bills, tax implications, and desired way of life.

- Tax Implications: Seek the advice of with a tax advisor to know the tax implications of withdrawing out of your 457(b) plan in retirement. Discover methods to attenuate your tax burden.

- Healthcare Planning: Plan on your healthcare bills in retirement. Contemplate Medicare and supplemental insurance coverage choices.

- Property Planning: Replace your property plan to incorporate your 457(b) plan belongings. Guarantee your belongings are distributed in keeping with your needs.

Past the Calendar: Essential Issues

- Funding Danger Tolerance: Your funding technique ought to align together with your danger tolerance. Youthful individuals would possibly tolerate extra danger, whereas these nearer to retirement might desire a extra conservative method.

- Diversification: Do not put all of your eggs in a single basket. Diversify your investments throughout completely different asset lessons to cut back danger.

- Charges: Take note of the charges related together with your 457(b) plan. Excessive charges can considerably affect your long-term returns.

- Skilled Recommendation: Contemplate looking for skilled recommendation from a monetary advisor or tax skilled. They may help you develop a customized retirement plan that meets your particular wants and targets.

- Plan Modifications: Concentrate on any modifications to your employer’s 457(b) plan. Often assessment plan paperwork and talk together with your plan administrator.

Conclusion:

The USD 457(b) plan gives a worthwhile alternative to construct a safe monetary future for presidency and non-profit workers. By utilizing a strategic, long-term method as illustrated by our conceptual calendar, understanding the plan’s options, and looking for skilled steerage when wanted, you may maximize the advantages of your 457(b) plan and obtain your retirement targets. Keep in mind that this text supplies common data and shouldn’t be thought of monetary or authorized recommendation. All the time seek the advice of with certified professionals for personalised steerage.

Closure

Thus, we hope this text has supplied worthwhile insights into Navigating the USD 457(b) Plan Panorama: A 2025-2025 Calendar and Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!

Leave a Reply